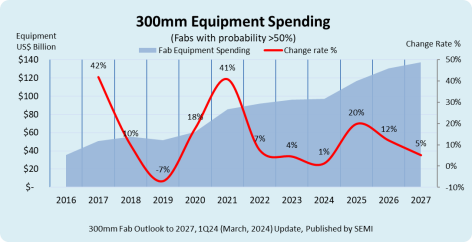

MILPITAS, Calif. — Global 300mm fab equipment spending for front-end facilities is forecast to reach a record US$137 billion in 2027 after topping US$100 billion for the first time by 2025 on the strength of the memory market recovery and strong demand for high-performance computing and automotive applications, SEMI highlighted today in its quarterly 300mm Fab Outlook Report to 2027 report.

Worldwide 300mm fab equipment investment is expected to increase 20% to US$116.5 billion in 2025 and 12% to US$130.5 billion in 2026 before hitting a record high in 2027.

“Projections for the steepening ramp of 300mm fab equipment spending in the coming years reflects the production capacity needed to meet growing demand for electronics across a diverse range of markets as well as a new wave of applications spawned by artificial intelligence (AI) innovation,” said Ajit Manocha, SEMI President and CEO. “The newest SEMI report also highlights the critical importance of increases in government investments in semiconductor manufacturing to bolster economies and security worldwide. This trend is expected to help significantly narrow the equipment spending gap between re-emerging and emerging regions and the historical top-spending regions in Asia.”

Regional Growth

The SEMI 300mm Fab Outlook to 2027 report shows China continuing to lead fab equipment spending with US$30 billion in investments in each of the next four years fueled by government incentives and domestic self-sufficiency policies.

Supported by leading-edge nodes expansion for high-performance computing (HPC) and the memory market recovery, Taiwanese and Korean chip suppliers are increasing their equipment investments. Taiwan is expected to rank second in equipment spending at US$28 billion in 2027, up from US$20.3 billion in 2024, while Korea is expected to rank third at US$26.3 billion in 2027, an increase from US$19.5 billion this year.

The Americas is projected to double 300mm fab equipment investments from US$12 billion in 2024 to US$24.7 billion in 2027, while spending in Japan, Europe & the Middle East, and Southeast Asia are expected to reach US$11.4 billion, US$11.2 billion, and US$5.3 billion in 2027, respectively.

Segment Growth

Foundry segment spending is expected to decline 4% to US$56.6 billion this year due in part to the expected slowdown in mature nodes (>10nm) investment, though the segment continues to log the highest growth among all segments to meet market demand for generative AI, automotive and intelligent edge devices. The segment’s equipment spending is forecast to post a 7.6% compound annual growth rate (CAGR) to US$79.1 billion from 2023 to 2027.

Demand for greater data throughput, crucial for AI servers, is driving strong demand for high-bandwidth memory (HBM) and spurring increased investment in memory technology. Among all segments, memory is ranked second and is expected to post US$79.1 billion in equipment investments in 2027, a 20% CAGR from 2023. DRAM equipment spending is expected to rise to US$25.2 billion in 2027, a 17.4% CAGR, while 3D NAND investment is projected to reach US$16.8 billion in 2027, a 29% CAGR.

The Analog, Micro, Opto, and Discrete segments are projected to increase 300mm fab equipment investments to US$5.5 billion, US$4.3 billion, US$2.3 billion, and US$1.6 billion in 2027, respectively.

The SEMI 300mm Fab Outlook Report to 2027report lists 405 facilities and lines globally, including 75 high-probability facilities expected to start operation during the four years beginning in 2024. The report reflects 358 updates and 26 new fabs/lines project since its last publication in December 2023.

For more information on the report or to subscribe to SEMI market data, visit SEMI Market Data