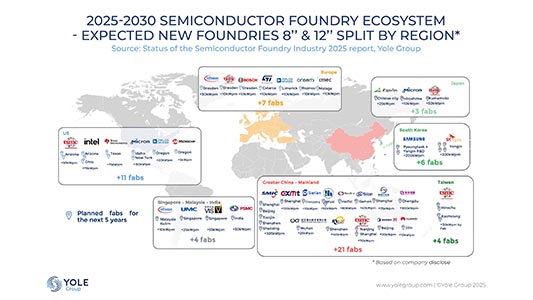

LYON, France – Yole Group unveils its latest Status of the Semiconductor Foundry Industry report, offering a comprehensive view into a sector undergoing profound transformation. At the crossroads of technology, geopolitics, and global market dynamics, this ecosystem is being reshaped by new capacity investments, regional power shifts, and long-term national strategies.

Yole Group’s 2025 analysis highlights how the global semiconductor supply chain remains highly fragmented and increasingly vulnerable to geopolitical tensions. Since the U.S. launched a semiconductor-focused trade war, mainland China has ramped up efforts to build a self-sufficient domestic ecosystem. In response, governments worldwide have launched significant subsidy programs to re-localize and fortify their semiconductor infrastructure.

One of the most impressive contrasts identified is in the U.S. market.

Pierre Cambou, Principal Analyst, Global Semiconductors at Yole Group, asserts: “While American semiconductor companies account for 57% of global wafer demand, they control only about 10% of foundry capacity locally. Indeed, the U.S. ecosystem relies heavily on foundry players located in Taiwan, Japan, and mainland China.”