Introduction

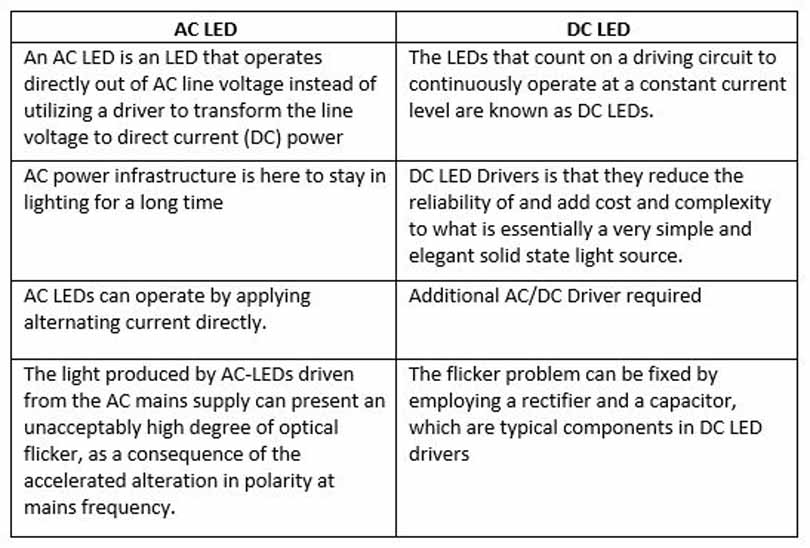

Light-emitting diodes (LEDs) are semiconductor devices that convert electrical energy into light. LEDs have many advantages over traditional lighting sources, such as incandescent bulbs and fluorescent lamps, such as higher efficiency, longer lifetime, lower maintenance cost, and environmental friendliness. However, most LEDs require a direct current (DC) power supply to operate, while the mains power supply in most countries is alternating current (AC). Therefore, an additional component called an LED driver is needed to convert AC power to DC power and regulate the current and voltage for the LEDs.

However, LED drivers also have some drawbacks, such as power loss, heat generation, flickering effect, and increased cost and complexity. To overcome these challenges, a new technology called DC LED chips has been developed, which can directly use AC power without any external driver modules. DC LED chips are basically multiple LED chips bonded directly to a substrate by the manufacturer to form a single module. An integrated circuit is embedded in the substrate to convert the AC power into a constant directional current for the LED chips.

DC LED chips have several benefits over conventional AC LED drivers, such as higher efficiency, lower heat dissipation, better dimming performance, and simpler design. In this article, we will explore the current market scenario, government initiatives, key market players and figures, latest government projects and initiatives, advantages of DC LED chips over AC LED drivers, and future prospects of this emerging technology.

AC LED Vs DC LED

Current Market Scenario

• The global LED lighting market has seen a prolonged growth with a size valued at USD 45.57 billion in 20181. The demand for LED lighting is driven by various factors, such as increasing awareness about energy conservation, government policies and incentives, declining prices of LEDs, and technological innovations. However, the global LED lighting market also faces some challenges, such as high initial cost of LEDs, lack of standardization, and competition from other lighting technologies.

• The global semiconductor market has also witnessed a strong growth in recent years, reaching USD 440 billion in 20202. However, the semiconductor industry has also faced some disruptions due to the COVID-19 pandemic, which affected the supply chain and production capacity of many chip makers. Moreover, the semiconductor industry is highly concentrated in a few countries, such as China, Taiwan, South Korea, and the US, which poses a risk of geopolitical tensions and trade wars.

• The global DC LED chip market is still in its nascent stage, with only a few players offering this technology. The market size of DC LED chips was estimated at USD 1.2 billion in 20193, and it is expected to grow at a compound annual growth rate (CAGR) of 16.5% from 2020 to 20273. The growth of the DC LED chip market is driven by the increasing demand for energy-efficient lighting solutions, especially in emerging markets such as India and China. The DC LED chip market is also supported by various government initiatives and policies that promote the adoption of LED lighting.

Government Initiatives

Many governments around the world have recognized the importance of developing a semiconductor and display manufacturing ecosystem in their countries to enhance their competitiveness and self-reliance in this strategic sector. According to a report by researchandmarkets.com, the Indian lighting market is expected to grow at a CAGR of 12.7% during the period of 2021-2026. The demand for energy-efficient lighting products is on the rise due to the increasing need for sustainable development. Some of the major government initiatives related to semiconductor and display manufacturing are:

SEMICON India: In December 2021, the Indian government approved a Rs 76,000-crore scheme to boost semiconductor and display manufacturing in the country in an bid to position India as a global hub for hi-tech production1. The scheme provides fiscal incentives for companies engaged in silicon semiconductor fabs, display fabs, compound semiconductors, silicon photonics, sensors fabs, semiconductor packaging and semiconductor design. The scheme aims to attract investments of around Rs 1.7 lakh crore and create 1.35 lakh jobs in the next four years1. The government is looking at least two greenfield semiconductor fabs and two display fabs in the country under this scheme1.

Make in India: The Make in India initiative was launched in 2014 to transform India into a global manufacturing hub. This initiative has not only boosted manufacturing in the country but has also increased employment opportunities for millions of people.

UJALA Scheme: According to the Electric Lamp and Component Manufacturers Association of India (ELCOMA), more than 75.8 crores ICLs and 40.8 crore CFLs were sold in India in 2012

To raise public awareness about the necessity of energy efficiency. On May 1, 2015, the Unnat Jyoti by Affordable LEDs for All UJALA scheme was established to promote energy efficiency at the domestic level and raise consumer knowledge about utilizing efficient equipment to cut electricity bills and benefit the environment.

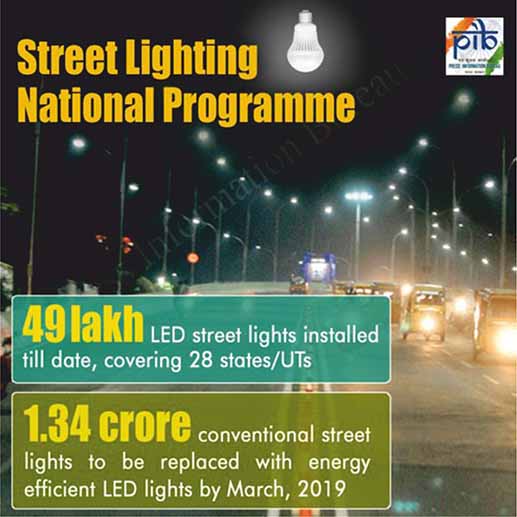

SLNP Programme: Street Light National Programme is an initiative of the Government to promote energy efficiency in the country. Government aims to replace 3.5 crore conventional street lights with energy efficient LED lights. This would result in annual energy saving of 900 crore units and the total cost savings of municipalities every year will be Rs 5,500 crore.

PLI Schemes: The white goods industry in India is highly concentrated. Indian appliance and consumer electronics (ACE) market reached INR 76,400 crore (~$10.93 bn) in 2019. Appliances and consumer electronics industry is expected to double to reach INR 1.48 lakh crore ($21.18 bn) by 2025.

The Indian LED Lights sector encompasses different segments like automotive lighting, general lighting and backlighting in commercial, residential, and industrial applications. The expected revenue growth in the Indian LED lighting market is at 12% CAGR.

The prime objective of the PLI scheme is to make manufacturing in India globally competitive by removing sectoral disabilities, creating economies of scale, and ensuring efficiencies. It is designed to create a complete component ecosystem in India and make India an integral part of the global supply chains.

The Production Linked Incentive (PLI) Scheme for promotion of domestic manufacturing of Air Conditioners and LED Lights in India of upto INR 6,238 crores ($855 mn) has been approved to be given over a period of 5 years.

Future Prospects

The future prospects of DC LED chips are promising, as they offer a viable solution for energy-efficient lighting in various applications, such as:

• Automotive: DC LED chips can be used for automotive lighting applications, such as headlamps, tail lamps, and interior lighting. DC LED chips can provide better visibility, safety, and aesthetics for vehicles. They can also reduce the weight and size of the lighting systems and improve their durability and performance.

• Display: DC LED chips can be used for display applications, such as LCD backlighting, OLED lighting, and microLED displays. DC LED chips can enhance the brightness, contrast, color gamut, and uniformity of the displays. They can also enable thinner and lighter displays with lower power consumption and longer lifetime.

• Smart Lighting: DC LED chips can be integrated with smart lighting systems that can adjust the light intensity, color temperature, and spectrum according to the user’s preferences or environmental conditions.

Conclusion

DC LED chips are an emerging technology that can directly use AC power without any external driver modules. DC LED chips have several advantages over conventional AC LED drivers, such as higher efficiency, lower heat dissipation, better dimming performance, and simpler design. DC LED chips are suitable for various applications, such as automotive, display, and smart lighting. The global DC LED chip market is expected to grow at a CAGR of 16.5% from 2020 to 2027. The growth of the DC LED chip market is driven by the increasing demand for energy-efficient lighting solutions, especially in emerging markets such as India and China. The DC LED chip market is also supported by various government initiatives and policies that promote the adoption of LED lighting. However, the DC LED chip market also faces some challenges, such as high initial cost, lack of standardization, and competition from other lighting technologies. Therefore, more research and development, innovation, and collaboration are needed to overcome these challenges and realize the full potential of DC LED chips.