Today, the market research and strategy consulting company Yole Group offers a special focus on the new microLED-based technology emerging in the automotive sector. Two leading LED companies, Osram and Nichia, have developed dedicated microLED solutions, enabling more than a 100-fold increase in resolution compared to current matrix LED systems based on discrete LEDs.

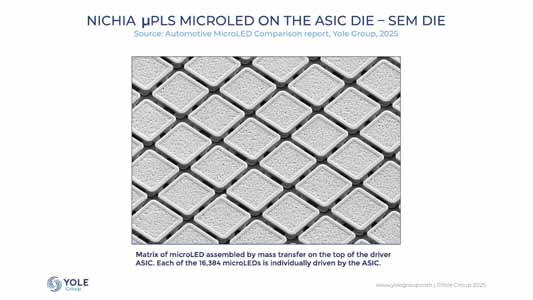

Both components have the same function, explains Yole Group in this new reverse engineering & costing report, Automotive MicroLED Comparison report, a LED matrix for an ADB (1). However, the technology choice is different, although both solutions are based on microLED technology. OSRAM has developed a technology to assemble a very large GaN chiplet on which 25,600 microLEDs are patterned. Nichia has developed a different process based on a mass transfer technology. 16,380 microLEDs are manufactured on a sapphire/GaN (2) substrate and assembled on an ASIC driver die. The two components are assembled in specific packages optimized to enhance thermal management.

Yole Group releases today the Automotive MicroLED Comparison report, which focuses on the reverse engineering and costing analysis of the first two microLED-based products on the market: the EVIYOS 2.0 from Osram and the µPLS from Nichia. Yole Group’s investigations underline the technological solutions adopted by both companies. The report examines the complex electrode and mirror structures fabricated on the microLED GaN wafer, the microLED integration process, and the final assembly and packaging steps. In addition, these analyses offer the technical intelligence necessary to understand these emerging technologies.

The Pixel LED EVIYOS developed by Osram is a pixel-based ADB device for automotive headlights. This reverse costing study provides insights into the technology, manufacturing costs, and selling price of the EVIYOS KEW GBBMD1U from Osram. The KEW GBBMD1U consists of a large matrix LED die bonded to an ASIC driver die. Each microLED, with a 40 µm pitch, is directly driven by the ASIC die, allowing for the individual control of all 25,600 microLEDs. This pixel ADB solution has been selected by Marelli for its high-end headlamp systems.

The EVIYOS 2.0 headlight has been integrated by Marelli into several cars, including the VW Touareg, Tiguan, Tayron (19 kpixels), Opel Grandland (25 kpixels), and Nio ET9 (25 kpixels).

In this new report, Yole Group’s analysts also detail the supply chain.

Sylvain Hallereau

Principal Analyst, Global Semiconductors at Yole Group

The driver die is designed and manufactured by ams-OSRAM at the ams 200 foundry in Austria. Ams acquired OSRAM in 2000. The LED die is produced by ams-OSRAM at their LED foundry in Malaysia. Additionally, based on our reverse engineering and cost analysis, we determined that the gold pad on the driver and the C2W bonding process are carried out by ams-OSRAM in Malaysia. We estimate that the packaging of the driver and LED die is also conducted by ams-OSRAM in Malaysia.

The second component analyzed is the µPLS microLED from Nichia, featuring 16,384 pixels.

Pierrick Boulay

Senior Technology & Market Analyst, Automotive Semiconductors at Yole Group

Nichia’s technology differs significantly, as it is based on the mass transfer of 16,384 individual discrete microLEDs onto an ASIC die. Each microLED, with a 50 µm pitch, is directly driven by the ASIC die. This pixel ADB solution has been chosen by Forvia Hella for their high-end headlamps.

This comparative analysis is part of Yole Group’s extensive portfolio of automotive research. From specialized Automotive Teardown Tracks to in-depth Semiconductor Market & Technology reports, Yole Group comprehensively explores semiconductor technology in automotive applications. Through this collection, the company offers valuable insights into industry innovations and their impact on the automotive sector.