Introduction

The semiconductor industry is the backbone of modern technology, driving advancements in various sectors such as telecommunications, automotive, and security. As the world becomes increasingly digital, the demand for semiconductors continues to surge. This article delves into the development of the semiconductor industry in India, the proposals by major companies for establishing fabrication units, the global industry outlook, the recent semiconductor crises, and the critical need for semiconductors in rapidly growing sectors. The semiconductor industry, a critical backbone of the modern digital age, continues to gain momentum globally and in India. With the advent of transformative technologies like 5G, AI, IoT, and electric vehicles, the demand for semiconductors has skyrocketed. For India, this presents an opportunity to emerge as a significant player in the global semiconductor ecosystem. This article delves into India’s efforts to bolster semiconductor manufacturing, recent global trends, and the growing demand from industries like telecom, security, and automotive.

Semiconductor Manufacturing Development in India

India’s journey towards becoming a significant player in the semiconductor manufacturing landscape has been marked by strategic initiatives and substantial investments. The Indian government has launched the India Semiconductor Mission, aiming to establish a robust semiconductor and display manufacturing ecosystem. This mission is supported by a substantial outlay of ₹76,000 crore, reflecting the government’s commitment to reducing dependency on imports and enhancing technological self-reliance.

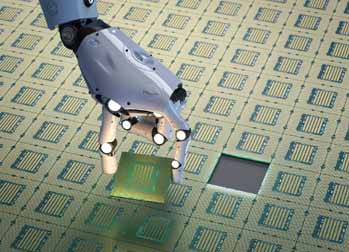

Recent developments include the approval of three new semiconductor units under this mission. Tata Electronics, in partnership with Powerchip Semiconductor Manufacturing Corp (PSMC) from Taiwan, is set to establish a semiconductor fab in Dholera, Gujarat, with an investment of ₹91,000 crore. This facility will focus on high-performance compute chips and power management chips for various applications. Additionally, Tata Semiconductor Assembly and Test Pvt Ltd (TSAT) will set up an advanced packaging unit in Assam, and CG Power, in collaboration with Renesas Electronics and Stars Microelectronics, will establish a specialized chip unit in Sanand, Gujarat.

Proposals by Tata, Vedanta, and Other Companies for Fab Development

Leading Indian conglomerates have taken decisive steps to capitalize on this opportunity. Tata Group, a name synonymous with industrial prowess, has ventured into semiconductor manufacturing. Through Tata Electronics, the group plans to invest heavily in semiconductor assembly and testing facilities.

Vedanta, in collaboration with Taiwanese electronics manufacturing giant Foxconn, has proposed a $20 billion investment to set up semiconductor and display manufacturing units in Gujarat. This ambitious project is expected to create thousands of jobs and establish India’s foothold in the global semiconductor supply chain.

Other industry players, including ISMC Analog Fab and Singapore-based IGSS Ventures, have also submitted proposals to establish semiconductor facilities in India. These initiatives reflect a robust interest from private enterprises and underline India’s potential as a semiconductor powerhouse.

Global Semiconductor Industry Outlook (SEMI Report)

According to the SEMI (Semiconductor Equipment and Materials International) Report, the global semiconductor industry is projected to exceed $1 trillion by 2030, driven by demand from AI, automotive, and IoT applications. The report highlights a positive outlook, with increasing investments in R&D and advanced manufacturing technologies.

Asia remains the epicenter of semiconductor manufacturing, with countries like Taiwan, South Korea, and China leading the charge. However, geopolitical tensions and the pandemic-induced supply chain crisis have prompted companies to diversify their manufacturing bases, presenting an opportunity for India.

The SEMI Report also emphasizes the need for public-private partnerships and government incentives to sustain growth. India’s efforts align with these recommendations, as evidenced by its policies and collaborations to attract global semiconductor giants.

Global Semiconductor Crisis

The semiconductor industry’s growth narrative is not without challenges. The global semiconductor crisis, which began in 2020, exposed the vulnerabilities of an over-concentrated supply chain. The pandemic disrupted production in major hubs like Taiwan and China, creating a ripple effect across industries.

Automakers, smartphone manufacturers, and even gaming console producers faced severe production delays. The crisis underscored the urgent need to decentralize semiconductor manufacturing and invest in new facilities.

India, with its burgeoning economy and strategic location, has positioned itself as a viable alternative. However, building semiconductor fabs is capital-intensive and requires cutting-edge technology and a skilled workforce. Overcoming these barriers will be critical to India’s aspirations.

Semiconductors in Telecom, Security, and Automotive Sectors

The rising demand for semiconductors in telecom, security, and automotive sectors underscores their indispensability in the modern economy:

- Telecom Sector: With the global rollout of 5G, semiconductors have become essential for manufacturing high-performance network equipment, smartphones, and IoT devices. India’s telecom industry, already a major contributor to the economy, will increasingly rely on indigenous chip manufacturing to meet demand and reduce dependency on imports.

- Security Sector: As cybersecurity threats grow, semiconductors play a crucial role in developing secure hardware solutions. From encrypted communication devices to biometric systems, semiconductors are foundational to enhancing national and corporate security.

- Automotive Sector: The automotive industry’s shift towards electrification and automation has fueled an unprecedented demand for semiconductors. Electric vehicles (EVs) require advanced chips for battery management systems, power electronics, and autonomous driving technologies. With India’s EV market gaining traction, a robust semiconductor supply chain will be pivotal.

Future Outlook for India’s Semiconductor Industry

India’s semiconductor journey is at an inflection point. By leveraging government initiatives, private sector investments, and a skilled workforce, India can carve out a significant role in the global semiconductor ecosystem. However, addressing challenges like high capital costs, technological gaps, and infrastructure limitations will be critical.

Collaboration will be key Partnerships with global leaders like TSMC and Intel can help India acquire cutting-edge technologies and fast-track its semiconductor ambitions. Moreover, India’s emphasis on renewable energy and sustainable practices can attract eco-conscious investors looking to establish green fabs.

As the world navigates the semiconductor revolution, India’s proactive approach could position it not only as a manufacturing hub but also as an innovation leader in this transformative industry.

Proposals by Major Companies for Fab Development

Several prominent companies have submitted proposals to set up semiconductor fabrication units in India, reflecting the country’s growing appeal as a semiconductor manufacturing hub. The Tata Group, in collaboration with Tower Semiconductor from Israel, has proposed the establishment of chip foundries with a combined investment of approximately $22 billion. This initiative is part of India’s broader strategy to attract global chipmakers by offering substantial incentives, including a 50% capital expenditure subsidy.

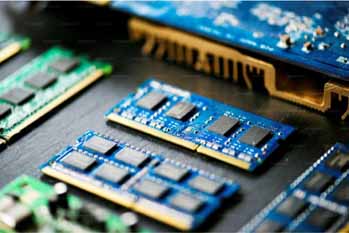

Other notable proposals include those from Vedanta and Foxconn, who initially planned a joint venture to set up a $19.5 billion chip plant. Although this partnership faced challenges, both companies are expected to submit separate proposals. Additionally, Micron Technology has cleared its proposal for a $2.75 billion ATMP (Assembly, Testing, Marking, and Packaging) plant in Gujarat, further strengthening India’s semiconductor manufacturing capabilities.

Global Semiconductor Industry Outlook

The global semiconductor industry has faced significant challenges and opportunities in recent years. According to the latest SEMI report, the industry experienced a revenue decline of 8.2% in 2023 due to factors such as inflationary pressures, geopolitical uncertainties, and supply chain disruptions. However, the outlook for 2024 is optimistic, with expectations of double-digit revenue growth driven by advancements in artificial intelligence (AI), cloud computing, and automotive electronics.

The integration of AI into various applications is a major growth driver, with high-bandwidth memory (HBM) and advanced packaging technologies playing crucial roles in meeting the demands of AI-driven workloads. The automotive sector continues to be a significant revenue driver, with the increasing computerization and electrification of vehicles. Despite ongoing challenges, the industry is poised for robust growth, supported by strategic investments and technological innovations.

More Global Semiconductor Crises

The global semiconductor industry has recently navigated through a severe crisis, primarily triggered by the COVID-19 pandemic. The pandemic caused massive disruptions in supply chains and logistics, leading to a significant shortage of semiconductors. This shortage affected over 169 industries, including automotive, consumer electronics, and telecommunications.

Several factors contributed to the crisis, including increased demand for PCs and other electronic devices due to remote work and learning, trade tensions between the US and China, and severe weather conditions in key manufacturing regions like Taiwan. The shortage highlighted the vulnerabilities in the global semiconductor supply chain and underscored the need for diversified manufacturing capabilities.

Need for Semiconductors in Telecom, Security, and Automotive Sectors

The demand for semiconductors is particularly pronounced in the rapidly growing telecom, security, and automotive sectors. In the telecommunications sector, the rollout of 5G networks and the proliferation of IoT devices are driving the need for advanced semiconductor solutions. High-performance chips are essential for enabling faster data transmission, improved connectivity, and enhanced network security.

In the security sector, semiconductors play a critical role in developing advanced surveillance systems, biometric authentication, and cybersecurity solutions. The increasing reliance on digital infrastructure necessitates robust and secure semiconductor components to protect sensitive data and ensure the integrity of communication networks.

The automotive sector is undergoing a transformative shift towards electric and autonomous vehicles, which rely heavily on semiconductors for various functions, including power management, sensor integration, and AI-driven decision-making. The integration of semiconductors in automotive applications enhances vehicle safety, efficiency, and connectivity, making them indispensable in the modern automotive landscape.

Recent News Updates

As we enter 2025, the semiconductor industry is witnessing significant developments. The ongoing trade tensions between the US and China continue to impact the global semiconductor supply chain. Recently, China launched an anti-monopoly investigation into Nvidia, which could have profound implications for global technology and trade. This move follows new restrictions placed on China by the US government, highlighting the geopolitical complexities affecting the semiconductor industry.

Additionally, the industry is preparing for transformative innovations driven by artificial intelligence. High-Bandwidth Memory (HBM) and advanced packaging technologies are at the forefront of these advancements, enabling real-time processing for AI applications. The focus on sustainability and efficiency is also driving innovations in power components, with materials like silicon carbide (SiC) and gallium nitride (GaN) playing crucial roles in addressing data center challenges.

Conclusion

The semiconductor industry is at a pivotal juncture, with significant developments in India and promising global prospects. India’s strategic initiatives and substantial investments are positioning it as a key player in the global semiconductor landscape. The proposals by major companies for establishing fabrication units further underscore the country’s potential. Despite recent crises, the global semiconductor industry is poised for robust growth, driven by advancements in AI, automotive electronics, and tele-communications. As the demand for semiconductors continues to rise, their critical role in enabling technological innovation and economic progress cannot be overstated.

By focusing on building a resilient and self-reliant semiconductor ecosystem, India can not only meet its domestic needs but also emerge as a global hub for semiconductor manufacturing, contributing significantly to the global supply chain and technological advancements.