Counterfeit electronic components are already a multi-billion dollar problem for original equipment manufacturers (OEMs) acquiring parts for production and repairs. In an uncertain and volatile tariff environment, the temptation to take shortcuts when it comes to sourcing obsolete or end-of-life components increases even more, especially when preferred authorized suppliers are shipping parts out of countries with hefty import duties. Counterfeiters, well aware that there is often no substitute for critical components and well-versed in making fakes look real, stand ready to take advantage of the situation.

Counterfeiters are opportunistic, but counterfeiting is nothing new. Where there is demand, there is money to be made. In 2024, it was estimated that more than 10 billion counterfeit parts were in the market worldwide, a figure likely far below the actual trade-in of fake parts because those on the receiving end may be unaware of, or disinclined to report, counterfeits that end up in their finished goods. And, of course, the counterfeiters themselves aren’t trumpeting their volume. “Buyer beware” remains sage advice—counterfeit parts imported from geographies that are less affected by tariffs still come with inherent risks, regardless of country of origin. In the end, the cost of part failure—fiscal and reputational—can be much higher than any import duties.

Rising demand creates opportunity for semiconductor manufacturers—and for counterfeiters

India’s growing semiconductor market is fueled by the country’s strong IT industry and increasing demand for electronics. As such, semiconductor volume—led by integrated circuits (ICs)—is projected to reach $13.3 billion by 2029, increasing at a compound annual growth rate (CAGR) of 10.7 percent from 2025 to 2029.

Globally, demand for semiconductors remains incredibly strong as innovation pushes forward more powerful chips in ever-smaller packages. The Semiconductor Industry Association noted that semiconductor sales reached $56.5 billion in January 2025, a 17.9 percent increase compared to January of last year. And that’s just one month’s tally. Sales topped $627 billion in 2024 and are on pace for double-digit market growth in 2025.

Semiconductors’ intrinsic presence in devices across sectors is like a candy store for counterfeiters, with chips of all flavors fair game. In 2024, the ERAI reported a 3 percent increase in reported counterfeit parts over 2023. While that may not seem like much, consider that a conservative industry assessment indicates that at least 1 percent of 1 trillion-plus units shipped are fake.

Counterfeiters aren’t choosy, either. ICs of all types top the list of the most often reported fakes, but transistors, relays, optoelectronics, power supply devices, and other parts are targeted as well. The top five are analog, microprocessor, memory, programmable logic, and interface ICs. The ERAI notes that most “suspect counterfeit parts” conveyed to the organization in 2024 were from brands never before reported, suggesting that counterfeiters target well-known and lesser-known brands with equal fervor. The ERAI is a global information services organization that monitors, investigates, and reports issues affecting the global electronics supply chain, with members that include aerospace, defense, medical, nuclear, and commercial OEMs, contract manufacturers, original chip manufacturers (OCMs), government agencies, industry associations, and others.

How counterfeiters do it

While the term “counterfeiting” may conjure up backroom operations with old tools in sketchy locales, that’s often far from the case. The technologies used for producing counterfeit components are becoming increasingly sophisticated. Advanced manufacturing processes produce fakes that are almost indistinguishable from genuine components, helped along by corporate espionage and stolen intellectual property such as chip designs. In 2023, for instance, Bloomberg reported that a former employee of ASML Holding NV—the global leader in photolithography machines used to produce computer chips—stole data from a software system the company used to store technical information about its machinery.

It doesn’t stop there. Flawless finishes make it difficult to determine when identifiers have been altered, even when examined using state-of-the-art testing and detection methods. Unimpeachable paper trails render that avenue of authentication untrustworthy. As companies learn to detect and counteract one method, a new approach pops up. It’s a cat-and-mouse game on a global scale.

Researchers continue to develop new methods for protecting semiconductors from malfeasance. At Purdue University, a team developed an optical anti-counterfeiting technique based on identifying modifications in the patterns of light scattered off gold nanoparticles embedded in chips or chip packaging. The method significantly outperforms current state-of-the-art detection methods, analyzing and verifying a pattern’s authenticity in 107 milliseconds with nearly 98 percent accuracy. Another system, CounterFoil, verifies provenance by extracting unique fingerprints from surface features of molded IC packages imaged using inexpensive labels, cameras, and readers, proof that low-cost strategies for counteracting counterfeiters continue to pique interest. The developers note that even if someone steals the mold used to make a chip package, they will have limited success in being able to counterfeit the chip.

While thieves can be quite accomplished in their methods, the most common counterfeiting threats are much more straightforward. These include:

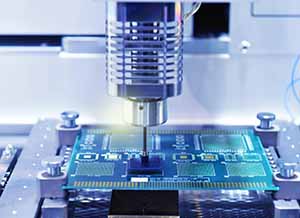

- Recycled electronic components pulled from discarded printed circuit boards that are repackaged and sold as new, whether functional or not

- Remarked components, packaging, and dies, whether to avoid detection or to create the impression that the parts are appropriate for use cases that require higher design specifications

- Cloning when bad actors get their hands on original design specs from foundries, assemblers, or test sites

- Reverse engineering may introduce flaws that go undetected until parts fail to perform

- Trojan software and malicious modification that renders technology vulnerable to attack long after hardware has been deployed

The careless handling of semiconductors, packaging, and chipmaking equipment involved in some of these methods can damage functionality and open the door to component performance issues that, left undetected, can cause the part to fail—sometimes catastrophically. Reputational damage and profit loss are two possible outcomes. Death is another. Electronic devices malfunction all the time. Whether the cause was a specific component and whether that was a counterfeit component is often shrouded by legally binding agreements. Nonetheless, a few cases do make their way into the headlines, such as those that surfaced issues with cellphone chargers, failed parachute deployment equipment, and fiery lithium-ion batteries.

The allure of the grey market

The grey market attracts buyers with an “always on, always available” siren song that can lure them to misfortune. Price pressures, real or perceived product scarcity, or the threat of mission-critical parts becoming obsolete can drive them into the arms of brokers. Even the most diligent may find themselves at the mercy of counterfeiters whose methods are more advanced than their own ability to detect flawed wares.

It is a particularly tricky situation for manufacturers of high-end devices, equipment, and finished goods, which cost millions to produce and are unlikely to be decommissioned when a single part goes bad. It’s just not economically feasible, for instance, to throw out a $3 million MRI machine or a $300 million fighter jet in need of a replacement part. Nor does it make sense to redesign items that are still in production the moment a semiconductor manufacturer declares that they will no longer produce the chips required for it. And it’s not just the design itself that’s affected—revamping production results in direct and indirect costs that can lead to significant revenue loss.

Even when finished goods are relatively inexpensive to produce, a hot item in a highly competitive market can prompt buyers to make risky decisions in the heat of battle as demand ramps up. It is highly likely that they aren’t the only ones on the hunt for a particular component, especially as fast followers bring their own devices to market. While powerful AI-era chips capture the imagination, most goods are embedded with more run-of-the-mill chips that are nonetheless essential to their ability to function. The more commonly used they are, the more people need them, and when scarcity is afoot, the grey market beckons.

Of course, just because a component was procured on the grey market doesn’t mean it’s not authentic or won’t function properly. But it also doesn’t mean that it will. Buyers who don’t have the time or tools to do their due diligence are taking their chances with components whose origin is obscured in a world of shadow players and whose performance is anyone’s guess.

The value of authorized distributors in the fight against counterfeiters

Doing business with an authorized distributor—one that has a direct relationship with an OCM—assures buyers that they are purchasing legitimate parts that will perform according to their specs, are likely under warranty, and come with tech support. In addition, authorized distributors’ capabilities often span the production lifecycle. To ensure a reliable flow of products, they may have specific expertise in design for manufacturing, supply chain management, and inventory management. They may also offer product lifecycle services such as repair, refurbishment, recycling, and IT asset disposition that help manufacturers build a stockpile of valuable replacement parts.

With such far-reaching expertise, authorized distributors are a valuable ally in the fight against counterfeiting, providing services that include:

- Co-creating proactive obsolescence mitigation strategies

- Negotiating extended lifetime buys

- Prolonging authorized component manufacturing

- Securing a continuous source of components for legacy products

- Advising on sound sourcing and supply chain decisions

- Delivering deep insights and inventory management expertise that alleviate production issues

- Proactively managing the supply chain to limit the opportunity for counterfeiters to exploit weaknesses

To be most effective, authorized distributors and their customers must work hand-in-glove to develop strategies that thwart counterfeiting. Collective vigilance mitigates risk, even for obsolete and end-of-life components. To find out more about the value of authorized distribution in counteracting counterfeiting, download the eBook.

About the author

Gary Beckstedt heads the quality and inspection labs for Flip Electronics as well as manages all logistics operations. Gary’s role requires him to institute and direct all quality management programs and processes as well as perform internal audits. Among his many challenges, Gary has the responsibility to ensure that Flip Electronics’ ISO/ANSI standards and certification programs, ESD programs, inspection, and counterfeit detection process, and personnel training are all in compliance with their respective requirements and procedures. Gary helps to identify and track industry changes that affect the supply chain and has supported the industry as a whole by serving on the G19-D committee that was tasked with maintaining the AS6081 standard. He is the company’s principal spokesperson in matters related to quality and methods of detection and abatement of counterfeit and suspect electronic parts. Gary is a US Air Force veteran, he began his electronics career in 1989. He operated and maintained RADAR systems to support the Desert Storm and Desert Shield campaigns.