Abstract

Today most semiconductors are made from silicon (Si) base material, but within recent years a relatively new semiconductor base material is making headlines. That is silicon carbide (SiC). SiC is recognized as a notable semiconductor because of its outstanding characteristics, for instance wide-bandgap, outstanding magnetic properties, extraordinary chemical inertness, high thermal, mechanical, optical and electronic properties, generally utilized in solid-state lighting and power electronics because of its insufficient inherent carrier and high thermal conductivity under high-power/high-temperature/high-voltage or other such harsh environments. In this article we will discuss about the advantages, Applications, challenges and acceleration towards decarbonization through SiC.

Introduction

Silicon carbide (SiC) plays an extraordinary role in many emerging technologies such as power electronics, optoelectronics, and quantum computing. Due to its fast switching speeds, low losses, and high blocking voltage SiC based power devices can lead a revolution in power electronics to replace Si-based technology. In power electronics and optoelectronics, the high localized heat flux leads to overheating of devices. The increased device temperature degrades their performance and reliability, making thermal management a grand challenge. High thermal conductivity (κ) is critical in thermal management design of these electronics and optoelectronics, especially for high-power devices.

Advantages of SiC over Si

Wide Band Gap semiconductors such as silicon carbide (SiC) are growing in importance because of their ability to offer significantly improved performance across a wide range of applications while reducing the energy and the physical space needed to deliver that performance when compared with conventional silicon technologies. In some applications where silicon as a power conversion platform has hit its physical limits, SiC technologies are becoming essential, while in others the benefits of efficiency, switching speed, size, weight and cooler, high-temperature, high-voltage operation combine to make SiC increasingly attractive. These material properties of SiC result in higher:

- Breakdown field

- Electron drift velocity

- Thermal conductivity

- Energy storage systems and improves efficiency

Breakdown Field

The higher breakdown field in SiC allows the device to withstand higher voltages for a given area. It helps gives device designers the ability to increase the area devoted to current flow for the same die size which lowers the devices resistance for a given area Rsp. The devices resistance is directly correlated to the conduction power losses, so a smaller Rsp will result in lower losses, yielding higher efficiency.

Electron Drift Velocity

Si based semiconductors have double electron drift velocity as compared to Si based semiconductor. It has two benefits. First, lower power losses during the transition time from on and off. Second, higher switching frequencies allow for the use of smaller magnetics and capacitors.

Thermal Conductivity

SiC has three times better thermal conductivity than Si. It allows SiC devices to operate up to 200°C compared to the typical 150°C limit of Si.

These advantages allows for the system designer to design a more efficient product while making it smaller, lighter, and ultimately at a lower cost. When adding the cost reductions from using smaller passive components and less thermal management, the overall system cost can decrease by 20%. Silicon carbide’s material properties make it highly advantageous for high power applications where high voltage, high current, high temperatures, and high thermal conductivity with less overall weight are required

Energy Storage Systems and Improves Efficiency

With various advantages, SiC solutions have also been widely adopted in power delivery systems, particularly in Energy Storage Systems (ESS) applications, such as electric vehicle charging systems and solar systems with battery energy storage. DC/DC boost converters, bidirectional inverters (for AC/DC and DC/AC conversion), and battery charging circuits in these systems can all benefit from SiC technology, resulting in a 3% increase in system efficiency, a 50% increase in power density, and a reduction in size and cost of passive components.

Advantage of Silicon Carbide (SiC) to Gallium Nitride (GaN)

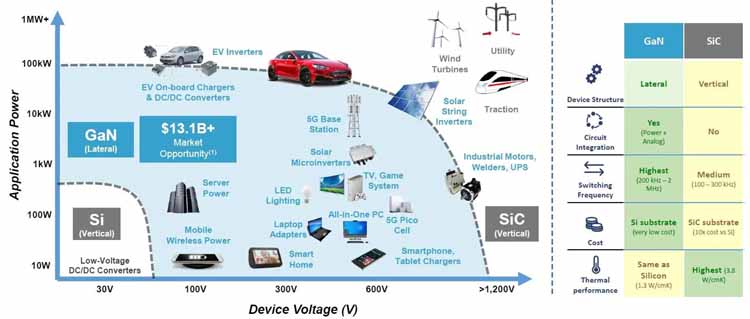

While SiC and GaN offer superior performance compared to Silicon, they come at a higher upfront cost. The long-term benefits, however, can be significant. For high-power applications, increased efficiency and reduced cooling requirements can lead to a better return on investment (ROI).

| Feature | SiC | GaN |

| Voltage | High (above 650V) | Medium (up to 650V) |

| Power | Medium to High | Low to Medium |

| Temperature Tolerance | High | Moderate |

| Frequency | Moderate | High |

| System Size | Larger | Smaller |

| Cost | Lower | Higher |

| Maturity | More Mature | Developing |

| Applications | Power grids, EV inverters, motors | RF devices, high-speed power supplies, compact designs |

Silicon Carbide SiC Wafer Market Size and Forecast

According to Verified market research Silicon Carbide SiC Wafer Market size was valued at USD742.7 Million in 2023 and is projected to reach USD 2,019.4 Million by 2030, growing at a CAGR of 20.3% during the forecast period 2024-2030.

According to valuates research the global Silicon Carbide Epitaxial Wafer revenue was US$ 227.8 million in 2022 and is forecast to a readjusted size of US$ 1667.4 million by 2029 with a CAGR of 32.5% during the forecast period (2023-2029).

In India, the Silicon Carbide Epitaxial Wafer revenue is expected to grow from US$ million in 2022 to US$ million by 2029, at a CAGR of 20.3% during the forecast period (2023-2029).

With players such as Cree (Wolfspeed), II-VI Advanced Materials (Ascatron), Showa Denko K.K.(NSSMC), Epiworld intenational, SK Siltron(Dupont), TYSiC, STMicroelectronics (Norstel), ROHM (Sicrystal) and so on the market for Silicon Carbide Epitaxial Wafer is concentrated. Among them, the top 3 manufacturers which include Cree (Wolfspeed), II-VI Advanced Materials (Ascatron), Showa Denko K.K.(NSSMC) are the leader with about 71% revenue market share in 2019.

Global Silicon Carbide SiC Wafer Market Drivers

The market drivers for the Silicon Carbide SiC Wafer Market can be influenced by various factors. These may include:

- Increasing Demand for Electric Vehicles (EVs): EV power electronics are made using silicon carbide wafers. Because SiC wafers improve power electronic component performance and efficiency, the demand for them has increased as electric car usage increases globally.

- Growing Interest in Renewable Energy: Solar inverters, which use SiC wafers, are a major use for SiC wafers in the renewable energy space. The need for SiC wafers in this industry has grown as attention has turned to clean and renewable energy sources.

- Applications in Power Electronics: Silicon carbide is a good choice for power electronics due to its strong thermal conductivity and stability at high temperatures. Its usage in industrial motor drives, power supply, and other high-power applications fall within this category.

- 5G Infrastructure Development: Advanced semiconductor materials are needed for the development of 5G networks, and silicon corundrum (SiC) is seen as a feasible alternative for high-frequency and high-power applications. The need for SiC wafers may increase as 5G infrastructure develops.

- Governmental programs and laws: The acceptance of SiC wafers in a range of applications can be influenced by government programs and laws that support the use of clean energy and energy-efficient technologies.

- Investments and Research: By lowering the cost and increasing the accessibility of SiC wafers, increased research and development expenditures in SiC technology, in conjunction with improvements in manufacturing techniques, can foster market expansion.

- Trends in the Automotive Industry: SiC wafers are used in advanced driver-assistance systems (ADAS) and other automotive electronics, in addition to electric vehicles. Innovations and trends in the automotive sector may have an effect on the SiC wafer market.

Enabling Industrial E-Mobility With SiC Technology

The EV ecosystem is strongly influenced by the presence of silicon carbide (SiC) power electronic devices, which allow the system to obtain multiple performance advantages.

The automotive industry is growing at a rapid pace through technological transformation. Indeed, the evolution from internal-combustion–engine (ICE) vehicles to electrically powered vehicles is spreading rapidly. In parallel, innovations in the semiconductor market for traction inverter systems and power conversion help overcome critical barriers to ever more widespread use. Driven by regulations around the world to reduce CO2 emissions, electric vehicles will achieve widespread adoption by 2030.

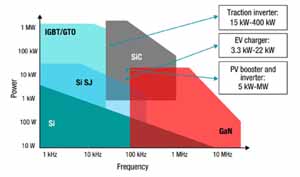

The applications for SiC MOSFETs and IGBTs have very similar power levels; however, they vary as the frequency increases. SiC MOSFETs are becoming increasingly common in power-factor–correction power supplies, solar inverters, EVs and hybrid vehicles, traction inverters for EVs, motor drives and railways. On the other hand, IGBTs are more common in motor drives, uninterruptible power supplies, string and central solar power inverters below 3 kW and EV/hybrid-vehicle traction inverters.

Diagram of power semiconductor device applications according to power levels and frequency (Source: Texas Instruments, 2021)

The ratio of vehicle electrification is growing across all transportation segments. Currently, 19% of EVs, more than 10% of construction and agriculture vehicles, 1 to 2% of water vehicles, and 45% of aircraft are fully and partially electrified. These segments are growing at CAGRs of 20% for EVs, 21.5% for construction and agriculture vehicles, 12.7% for water vehicles, and 13% for aircraft from about 2023 to 2030.

The Future of GaN and SiC

IDTechEx predicts the market share for SiC MOSFETs to be well over 50% by 2035, accompanying significant growth in the automotive power semiconductor market.

However, IDTechEx acknowledges that GaN will enter the EV power electronics market over the next 5 years. This market entry will vary by component: earlier for the onboard charger, DC-DC converter, and later for the traction inverter. Although GaN isn’t there yet, developments in substrate technology, vertical devices, and multi-level topologies will be accompanied by investments from large players in the automotive power semiconductor space, such as ROHM, Infineon, and Renesas. This will soon make GaN a realistic and widespread solution for EV power electronics. Over the next decade, one can expect the coexistence of Si, SiC, and GaN in the EV power electronics ecosystem. IDTechEx’s new report on the topic, “Power Electronics for Electric Vehicles 2025-2035: Technologies, Markets, and Forecasts”, provides insights into these technologies and applications, identifying the potential market opportunities.

Despite the short-term deceleration in BEV segment, the shift to 800V will escalate the demand of silicon carbide. Several semiconductor manufacturers have recently unveiled plans to expand their silicon carbide (SiC) production capacity to meet rapidly increasing market demand.

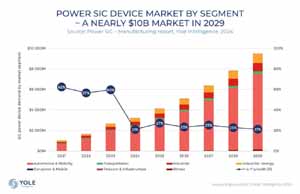

As highlighted in the Power SiC and GaN Compound Semiconductor Market Monitor, Q2 2024 from Yole Group, the power SiC device market will reach nearly $10 billion by 2029, with automotive and mobility as well as transportation accounting for close to $8 billion.

Future Trends of SiC and GaN in EVs

As electric vehicles (EVs) transition to 800 V and higher systems, silicon carbide (SiC) will play a key role in enabling more efficient drivetrains, superior performance, longer ranges and faster charging times.

SiC MOSFETs present a smaller form factor and can also decrease the size of accompanying passive components, such as the inductor in a traction inverter. Lighter and more efficient, the range of a BEV can be increased by approximately 7% by switching from Si IGBTs to SiC MOSFETs in the inverter, tackling consumer concerns about range. On the other hand, by using SiC MOSFETs, one could get the same range with a reduced battery capacity, contributing to a lighter, lower cost, and more sustainable vehicle.

According to Navitas, SiC is a great solution for 1,200 V and above, as well as above-100-kW applications in which it would be more difficult for the lateral GaN technology to meet those power levels.

GaN solutions are lateral and allow for circuit integration. They can operate at really high switching frequencies. According to Navitas, GaN can reach up to 40 MHz.

Acceleration towards Decarbonization

The goal of achieving carbon neutrality has gained momentum worldwide. Many steps are being taken to transform our global energy system, including a dramatic reduction in reliance on fossil fuels. The adoption of wide-bandgap semiconductors made from materials like SiC will provide energy-efficient devices that have almost no losses, creating a sustainable path to achieving net zero carbon emission.

Electric vehicles contribute towards decarbonization by directly reducing the number of pounds of CO2 that are emitted due to transportation. They have zero tailpipe emissions; however, they consume electricity that is produced by CO2 emitting sources. Including these emissions, the U.S. DoE averages the annual emissions of an EV to be 2,817 pounds of CO2 versus 12,594 pounds of CO2 from a vehicle that uses gasoline. That is a 78% reduction in the amount of CO2 emitted into the atmosphere.

EV charging stations do not have a direct impact on decarbonization, but without a robust infrastructure of DC fast charging stations, the adoption of EVs will be limited. Range anxiety remains a large contributor to the lack of EV adoption. Ninety percent of U.S. households that own an EV own another vehicle that is likely not an electric vehicle. These stats highlight that consumers do not have confidence that their EV can satisfy all their needs, specifically, long-distance trips.

Since 2009, the cost of photovoltaics (PV) solar energy generation has dropped nearly ninety percent, making it the lowest cost source of energy generation at $37/MWh as of 2020. Compare this to coal at $112/MWh and natural gas at $59/MWh. Solar is allowing the world to generate energy with zero emissions of CO2 all while doing it at the lowest cost of other energy sources. SiC cannot take credit for this cost reduction in its entirety, but it is a contributing reason to solar energy generation decreasing in cost.

SiC semiconductors help accelerate the adoption of these end-systems by making them more efficient, reliable, robust, smaller, lighter, and with an overall lower cost.

Conclusion:

This article provides a recent progress in the SiC, its advantages over Si and GaN, Recent Market Trends, its applications and challenges. However, SiC in power electronics is on track to reach $10B in revenue by the end of this decade, and the strong growth in 2023 was a crucial step in multiple applications. They also said there is a concern that shipments are slowing down due to the weakness of the global economy. Many players are re-evaluating the timing of the return to growth; could it be in Q3 of 2024 or later? The SiC supply chain is closely monitoring it, as 2024 results will be highly impacted.

Another critical consideration is the demand-supply issue. In the past years, SiC wafer was in tight supply; an LTA with a wafer supplier is essential to secure access to SiC wafers. However, following significant capacity expansion in the past two years, the discussion is moving to price and the risk of overcapacity, says Yole.