SiC and GaN Semiconductors Advances in silicon carbide and gallium nitride technologies have been characterised by development, expanding industry adoption, and the prospect of billion-dollar profits throughout the previous few decades. The first commercial SiC device, a Schottky diode from Germany’s Infineon, appeared in 2001. Tremendous growth has ensued, and the industrial sector is currently expected to approach US$4 billion by 2026.

GaN initially dazzled the industry in 2010, when Efficient Power Conversion (EPC) of the United States introduced its super-fast switching transistors. While market penetration has not yet reached SiC levels, power GaN sales might exceed $1 billion by 2026.

High-voltage, high-power applications like consumer electronics chargers and battery electric automobiles are accelerating gallium nitride and silicon carbide semiconductors. Semiconductors began with the 1950 point-contact transistor. Silicon, a better semiconductor material, replaced germanium and is still used today.

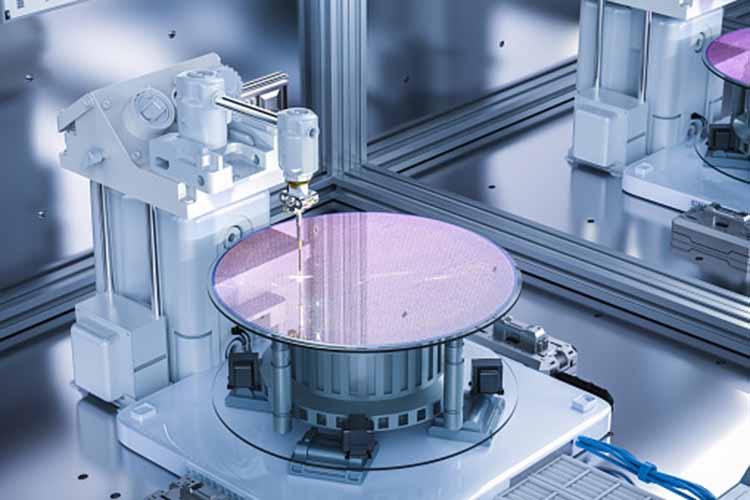

With precise semiconductor manufacturing equipment and optimised device architectures and wafer processes, silicon semiconductor products have emerged. This helped shrink and improve everyday electronics.Yet, compound semiconductors with physical properties much superior than silicon-based semiconductors have been developed and used in power semiconductor applications.

Gallium nitride and silicon carbide semiconductors are advancing due to high-voltage, high-power applications such as consumer electronics chargers and battery electric autos.Semiconductors were invented in 1950 with the point-contact transistor. Silicon, a superior semiconductor material, eventually supplanted germanium and is still in use today.Silicon semiconductor goods have evolved as a result of precision semiconductor production equipment, optimised device layouts, and wafer processes. This aided in the reduction and improvement of ordinary electronics.

However, compound semiconductors with much greater physical qualities over silicon-based semiconductors have been created and employed in power semiconductor applications.

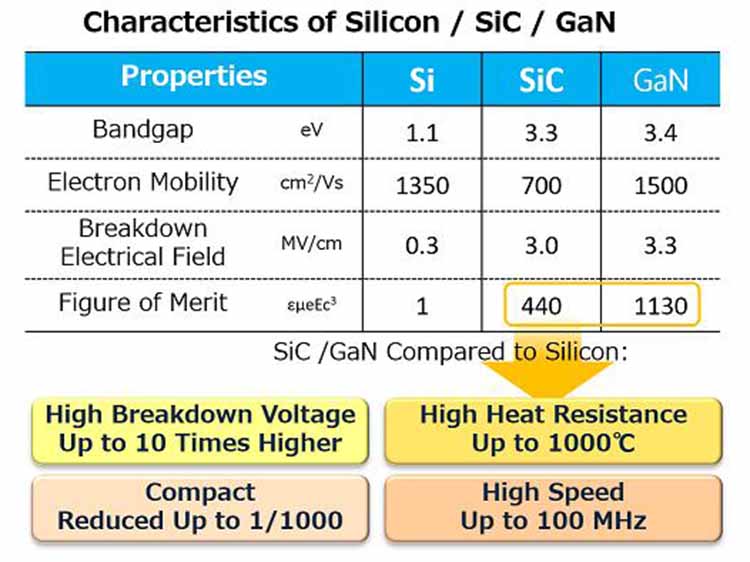

The two major semiconductor materials used in the manufacture of power semiconductors are silicon carbide (SiC) and gallium nitride (GaN). Because to the lower inherent carrier concentration in both materials compared to silicon, it is feasible to raise the operating temperature of the semiconductor by lowering leakage current. These materials are also perfect for high temperature and high power density converter implementations due to the thermal conductivity of SiC and the stable on state resistance in GaN devices.

The next generation of power conversion and motor drive applications has been advanced by the market’s availability of both SiC and GaN devices. Although having many comparable advantages, such as substantially reduced physical package sizes, there are some distinctions in the use cases they are best suited for.

Industrial motor drives, DC/DC converters, and solar inverters are replacing IGBTs with SiC WBG transistors, which can handle 1200 V or more. They have lower switching losses than silicon devices and higher switching frequencies than GaN, although not as high. SiC devices reduce waste heat by reducing switching losses.

GaN has been slower to commercialise than SiC. It is making improvements in power conversion, motor drives, long-range radar, and RF broadcast systems. They compete with MOSFETs and IGBTs up to 650 V, but not as high as SiC devices. They switch up to x1000 quicker than silicon discretes and have minimal switching and conduction losses, making them energy-efficient conversion or driving functions.

According to a recent report by Global Market Insights Inc., the GaN and SiC power semiconductor industry may approach $4.5 billion in sales by the end of 2027 as a result of continuous improvements.

Why are GaN and SiC power ICs gaining traction worldwide?

Due to their capacity to give increased performance across a variety of applications, including the automotive sector, power supply, PV inverters, industrial motor drives, and others, power ICs like SiC and GaN are becoming more and more important. As compared to more established silicon-based ICs or technologies, these ICs may minimise the energy and physical space needed to achieve improved performance.

GaN and SiC technologies would assist satisfy the need while reducing carbon emissions as the demand for energy rises. A worldwide Si-to-GaN data centre upgrade is predicted to minimise energy loss by 30% to 40%, which would result in about 125Mtons of carbon dioxide emissions and 100TWhr saved by the end of 2030.

In the instance of GaN, the GaN power IC chip is estimated to save over 80% in manufacturing and process chemicals and energy, as well as more than 50% in packaging.

Recent advancements in the utilisation of GaN/SiC technology across several sectors will offer fuel to market growth. Teledyne e2V HiRel Electronics and Integra Technologies Inc., for example, formed a collaboration to develop 100V GaN/SiC RF technology for greater dependability in military and aerospace applications.

Electric and hybrid electric cars are the future of automotive success. In 2020, electric vehicle sales hit a new high of 3 million units.

GaN and SiC: Optimal for 5G networks

The most recent network, 5G, will fuel the Internet of Things in the modern day. In fact, predictions suggest that by 2025, 5G networks will have reached 1/3 of the global population.

At roughly 20 times the speed of current 4G networks, 5G networks would be able to download videos at up to 10 times the rate. High-performance power semiconductors are required for this. To the rescue come SiC and GaN semiconductors, which are essential to 5G RF solutions, base-station power supply, and wireless power transmission. Gallium nitride offers advantages over other technologies for usage in 5G power amplifiers due to its high frequency properties.

Due to the Indian government’s incentives to promote semiconductor production in India, prominent firms such as Vedanta and Tata have entered the field. The nation has also seen corporations form joint partnerships, which might lead to high-value commercial initiatives.

But, it is not just huge corporations that are attempting to join the semiconductor manufacturing business. Powency Circuits, located in Gujarat, is a startup that is attempting to create III-V compound semiconductor production in India, including epitaxi wafers (GaN on Si, GaN on SiC), high mobility device fabrication, turnkey solution, and high power devices utilising GaN, GaAs material.

- Electric and hybrid electric cars hold the key to each technology’s future commercial success. The EV/HEV industry is definitely the sweet spot for SiC, accounting for at least 60% of the more than US$3 billion market.

- In 2017, Tesla became the first carmaker to employ SiC MOSFETs in a vehicle, launching the SiC power device business (the Model 3). The STMicroelectronics device was combined with an in-house primary inverter design. Hyundai, BYD, Nio, General Motors, and other manufacturers have quickly followed suit.

- Geely Automotive of China has announced a collaboration with Rohm Japan on SiC-based traction inverters for its EVs. NIO, China’s answer to Tesla, will use an electric drive system based on SiC in its cars. Meanwhile, BYD, an automobile and semiconductor manufacturer, has been developing SiC modules for its complete EV lineup.

- Yutong, a Chinese electric bus maker, said last year that it would employ SiC power modules made by StarPower China in its bus powertrains. Wolfspeed SiC devices are used in the modules.

- Hyundai will include Infineon’s SiC-based power module for 800-V battery systems into its electric vehicles. Toyota uses Denso SiC booster power modules in its Mirai fuel-cell EVs in Japan. In addition, GM has contracted with Wolfspeed to provide SiC for its EV power electronics.

- European automakers have been slower to adopt SiC, but this is changing. Renault and STMicroelectronics collaborated in June to develop SiC and GaN devices for EVs and HEVs. Further announcements from Daimler, Audi, and VW are likely shortly.

Early industry developments indicate this is possible.

- Nexperia of the Netherlands collaborated with Ricardo of the United Kingdom to create a GaN-based EV inverter design in February 2020. VisIC Technologies of Israel announced a collaboration with German car supplier ZF to develop GaN semiconductors for 400-V driveline applications.

- Then, in September, GaN Systems announced a US$100 million agreement with BMW to provide the capacity to produce GaN power devices for the German automaker’s EVs, demonstrating that OEMs are serious about GaN.

- In another important move, Navitas will combine with special-purpose acquisition business Live Oak Acquisition to create a publicly listed corporation with a market value of US$1.04 billion. The GaN power IC player recently announced that it will provide devices for on-board chargers and DC/DC converters to Swiss-based Brusa HyPower. It plans to put its weight behind product development for EVs/HEVs and other markets as a public corporation.

- Apart from those agreements, collaborations, and mergers, early work on GaN modules suggests that the compound semiconductor is following in the footsteps of SiC, with industry participants preparing for more comprehensive industry integration. GaN Systems, for example, provides a power assessment module kit to design engineers, while Transphorm has collaborated with Fujitsu General Electronics on a GaN module aimed at industrial and automotive applications.

That’s all Folks!

By the year 2026, it is anticipated that consumer electronics chargers would account for 66% of the market for GaN chips, while automotive applications, primarily BEVs, may account for as much as 60% of the market for SiC chips. Both gallium nitride and silicon carbide, which are both high-power materials, have their cost-effectiveness limited by the manufacturing procedures that are now in use, which makes both of these high-power materials more costly in the near future. Yet, the use of either material in a particular semiconductor application confers significant benefits.

It is simpler to produce bigger and more uniform wafers of silicon carbide than it is of gallium nitride, which means that silicon carbide may prove to be a more useful product in the near run. Since gallium nitride has a greater electron mobility than other materials, it will eventually find a use in devices that are tiny and high-frequency. Since silicon carbide is capable of producing more power and has a greater thermal conductivity than gallium nitride, it will be the material of choice for use in bigger power products.